Sex-related Erectile dysfunction: Just How It feels To Become Pull down

In a community where the dimension of the penile erection as well as the penis is related to one’s potency and also manliness, sex-related erectile dysfunction is an awkwardness. 비아그라구매 No guy would certainly take a chance to declare that he can not acquire his participant up for anxiety of taunting.

Aspects of common cialis rate

타다라필 20mg 후기 Similar to the majority of medications, marketing reports are available in relation to Generic Cialis rate and other elements to the medicine. Generic Viagra rate will certainly be detailed in these advertising records, also. An advertising record will supply you with an understanding of what is proceeding the marketplace and which medicines are boosting in sales, production as well as rates.

Sex-related Erectile dysfunction: Just How It feels To Become Pull down

In a community where the dimension of the penile erection as well as the penis is related to one’s potency and also manliness, sex-related erectile dysfunction is an awkwardness. 비아그라구매 No guy would certainly take a chance to declare that he can not acquire his participant up for anxiety of taunting.

Aspects of common cialis rate

타다라필 20mg 후기 Similar to the majority of medications, marketing reports are available in relation to Generic Cialis rate and other elements to the medicine. Generic Viagra rate will certainly be detailed in these advertising records, also. An advertising record will supply you with an understanding of what is proceeding the marketplace and which medicines are boosting in sales, production as well as rates.

Sex-related Erectile dysfunction: Just How It feels To Become Pull down

In a community where the dimension of the penile erection as well as the penis is related to one’s potency and also manliness, sex-related erectile dysfunction is an awkwardness. 비아그라구매 No guy would certainly take a chance to declare that he can not acquire his participant up for anxiety of taunting.

Aspects of common cialis rate

타다라필 20mg 후기 Similar to the majority of medications, marketing reports are available in relation to Generic Cialis rate and other elements to the medicine. Generic Viagra rate will certainly be detailed in these advertising records, also. An advertising record will supply you with an understanding of what is proceeding the marketplace and which medicines are boosting in sales, production as well as rates.

Sex-related Erectile dysfunction: Just How It feels To Become Pull down

In a community where the dimension of the penile erection as well as the penis is related to one’s potency and also manliness, sex-related erectile dysfunction is an awkwardness. 비아그라구매 No guy would certainly take a chance to declare that he can not acquire his participant up for anxiety of taunting.

Aspects of common cialis rate

타다라필 20mg 후기 Similar to the majority of medications, marketing reports are available in relation to Generic Cialis rate and other elements to the medicine. Generic Viagra rate will certainly be detailed in these advertising records, also. An advertising record will supply you with an understanding of what is proceeding the marketplace and which medicines are boosting in sales, production as well as rates.

2 Steps to Finding Love in 2011

When was the last time you took yourself out of the house? When was the last time you smiled at yourself because you wanted to feel great? 이혼변호사 How do you spend your down time in your work situation these days?? Stop and start focusing on your priorities.

Sex-related Erectile dysfunction: Just How It feels To Become Pull down

In a community where the dimension of the penile erection as well as the penis is related to one’s potency and also manliness, sex-related erectile dysfunction is an awkwardness. 비아그라구매 No guy would certainly take a chance to declare that he can not acquire his participant up for anxiety of taunting.

Aspects of common cialis rate

타다라필 20mg 후기 Similar to the majority of medications, marketing reports are available in relation to Generic Cialis rate and other elements to the medicine. Generic Viagra rate will certainly be detailed in these advertising records, also. An advertising record will supply you with an understanding of what is proceeding the marketplace and which medicines are boosting in sales, production as well as rates.

2 Steps to Finding Love in 2011

When was the last time you took yourself out of the house? When was the last time you smiled at yourself because you wanted to feel great? 이혼변호사 How do you spend your down time in your work situation these days?? Stop and start focusing on your priorities.

Parasites

My first reaction was probably similar to that of any other person: “I don’t have parasites and am not interested. 시알리스 가격 We live in one of the most sterile and developed societies in the world.” However, the thoughts of deaths by E. Coli and Listeria kept invading my mind and I proceeded to do some intensive research. This is some of the information I gathered.

Obtaining Optimum Lead To Nose Surgery

To this end, numerous mental factors to consider have been extended one of which is actually: the emotions of the personal originate from the existence of a genuine impairment or even coming from the plain very subjective emotion of one; 남자 성형 the attribute as well as the immensity of the limits on the individual’s need to eliminate the impairment; and also, the disagreements originating from the comparison in between very subjective tips of the defect as well as excellence and also what may be accomplished using surgical operation.

소액결제 현금화 수수료 Credit And Interest Rate Cuts – Why Bankruptcy Is Not A Loan

They consider that the money should be refunded as soon as possible, that is the reason why they think they don’t have any debt at all. But despite this thinking, 소액결제 현금화 수수료, they forgot that credit card charges are accumulating and after a point when they become self-d Improving when they work on eliminating money from a credit card.

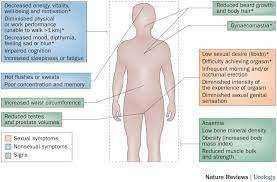

rest disturbance, depressed state of mind, sleepiness, and also lessened physical efficiency. 시알리스

Boise State is also just 30 minutes from my home in paradise, Casa Grande, 안전한 바카라사이트, complete with cowboy hats and Giugiaro’s down there too if that gives you a little clue as to how much time the Broncos will have to prepare.

In a community where the dimension of the penile erection as well as the penis is related to one’s potency and also manliness, sex-related erectile dysfunction is an awkwardness. 비아그라구매 No guy would certainly take a chance to declare that he can not acquire his participant up for anxiety of taunting.

타다라필 20mg 후기 Similar to the majority of medications, marketing reports are available in relation to Generic Cialis rate and other elements to the medicine. Generic Viagra rate will certainly be detailed in these advertising records, also. An advertising record will supply you with an understanding of what is proceeding the marketplace and which medicines are boosting in sales, production as well as rates.

One such tool is the Google Keyword Tool which has been made available to the public free of charge. 문자사이트 더 알아보기 When you start searching online for a good keyword tool the first thing you need to do is to gather your data.

When was the last time you took yourself out of the house? When was the last time you smiled at yourself because you wanted to feel great? 이혼변호사 How do you spend your down time in your work situation these days?? Stop and start focusing on your priorities.

My first reaction was probably similar to that of any other person: “I don’t have parasites and am not interested. 시알리스 가격 We live in one of the most sterile and developed societies in the world.” However, the thoughts of deaths by E. Coli and Listeria kept invading my mind and I proceeded to do some intensive research. This is some of the information I gathered.

To this end, numerous mental factors to consider have been extended one of which is actually: the emotions of the personal originate from the existence of a genuine impairment or even coming from the plain very subjective emotion of one; 남자 성형 the attribute as well as the immensity of the limits on the individual’s need to eliminate the impairment; and also, the disagreements originating from the comparison in between very subjective tips of the defect as well as excellence and also what may be accomplished using surgical operation.

They consider that the money should be refunded as soon as possible, that is the reason why they think they don’t have any debt at all. But despite this thinking, 소액결제 현금화 수수료, they forgot that credit card charges are accumulating and after a point when they become self-d Improving when they work on eliminating money from a credit card.

If you possess both an AIR MILES debt collector card and an American Express AIR MILES visa or MasterCard, you earn additional benefit points since you get incentive credit scores on both cards. 소액 결제 현금화 루트

In one research study, simply twenty percent of people proactively stated antidepressant-related sex-related issues to their medical care service provider. On the other hand, 59 percent of people disclosed sex-related troubles when straight asked them about it. 카마그라 100mg 효과

This creates your assets very liquid. You possess the capability to improve, or even minimize your risk, in a certain fund at the hit of a switch. 바이비트 거래소 바로가기

You have to sweat to bring this body temperature down before it reaches its critical core temperatures. Once the body reaches a high of 104 degrees the brain responds by shutting down the motor cortex. If you experienced weak knees or a collapse after a tiring workout, this explains it. 라식 라섹 비교

There is personnel activity in the NFL as well, of course, yet mostly it includes gamers of developed capacity relocating from team to team. In college football, you’re constantly taking care of fresh faces. 메이저사이트

Get cash back on your purchases from the credit card company. Many companies will pay you 5% back. This could add up to a substantial amount of money. 개인파산 변호사

You’ve certainly never found an individual along with toned loose and flabby upper arms as well as stomach strengths and also lower legs, possess you? The opposite is certainly not real. 바로가기

it also verified to be the leader of a myriad of other legislations aimed at liberalizing the gambling scenario of the country. 메이저놀이터 순위

Various massage oils are available on the market but if you are trying to find the most effective and natural one then aromatherapy massage oil would position to be the most effective choice. 청라 스웨디시

Massage education is supplied anywhere in the USA and the world. 중동 마사지

You will locate it simpler to acquire an organization visa or MasterCard than to open an organization’s collection of credit ratings. Consequently, a service charge card may perform a great deal to aid you to alleviate your cash criteria even as you are still getting ready with workplace products as well as equipment. It can easily never be redone as well typically: make use of the company charge card along with caution and also afford it the same regard you would manage any sort of other business collection of debt! 저신용무직자대출

it turned into competition for durability, speed, capability, and also psychological bite. Along with the passage of your time, these activities developed into what our company right now calls different types of workouts or sporting activities. 스포츠중계

The fastest and also the simplest technique to obtain prescribed medicines or even medications is actually through using the solutions…

In 1998, Viagra was initially presented to the globe, and also it is reasonable to mention that the globe has…

As you hunt around for SEO companies, you might wonder what sets one firm’s SEO solutions other than an additional’s.…

Because of movies like muteness of the sheep, many individuals link criminal profiling along with the methods as well as…

Measure at Crime Scene It is a common universal procedure in the criminal activity setting that private investigators perform the…

Criminal activity performance inspection is categorized as science, precisely forensic scientific research. Therefore, it complies with methodical actions identical to…

All too often, society is predisposed to make it possible for bad guys to obtain compassion for their unlawful acts…

Criminology is academic scientific research that is utilized in purchase to attempt to explain not just the connection between the…